Financial benefits of living in a modest home and tips for avoiding lifestyle creep

by FI Designer

The cost of housing is one of the largest factors that influence your overall financial success.

This post discusses the historic trends in single-family home sizes in America and the financial benefits of deviating from this trend by living in a modestly-sized home.

A starter home or starter house is a house that is usually the first which a person or family can afford to purchase, often using a combination of savings and mortgage financing according to Wikipedia. The modest size of a starter house may be adequate for the needs of an individual or new family but may not fulfill their future needs or desires. In contrast, a forever house would be one that may exceed your needs at the time of purchase but would more likely meet the future needs and desires of your family.

Historic Trend

American homes have gotten much bigger over the decades. According to the 2019 U.S. Census, the average size of newly constructed single-family houses was 2,509 square feet. That is nearly double the size of the average house size of 1,289 square feet in 1960. And while home sizes have increased over that period, the number of people in each household has decreased. In 2019 the average floor space was 996 square feet per person, while in 1960 it was 387 square feet per person. These trends are shown in greater detail in the graph and table below.

What has Driven the Trend?

The simplest explanation to why Americans want bigger houses is because they can. Economic prosperity and years of record-low interest rates coupled with aggressive marketing have fueled the trend of larger homes. Another factor is the desire to show one’s social status by buying expensive and outwardly visible items such as the idiom of “keeping up with the Joneses“.

The conventional wisdom that one should buy the biggest house one can afford has also driven the trend of larger houses. This behavior is aligned with mortgage prequalification practices and realtors that are both incentivized to maximize their own fees, not your savings rate.

Drawbacks of Larger Homes

Larger homes have significant drawbacks. Perhaps the second greatest expense, after the upfront purchase price, are the property taxes that go on in perpetuity even after the mortgage is paid off. In a moderate to high property tax state that can have the financial equivalent of buying a used car every year.

Other drawbacks of larger homes include increased time and expense required for maintenance versus a smaller home. A larger home will require more furnishings and allow more material items, i.e. stuff, to accumulate. Entropy happens, possessions will tend to grow to fill the space available. Finally, larger homes with tall ceilings or more rooms required more energy to heat and cool.

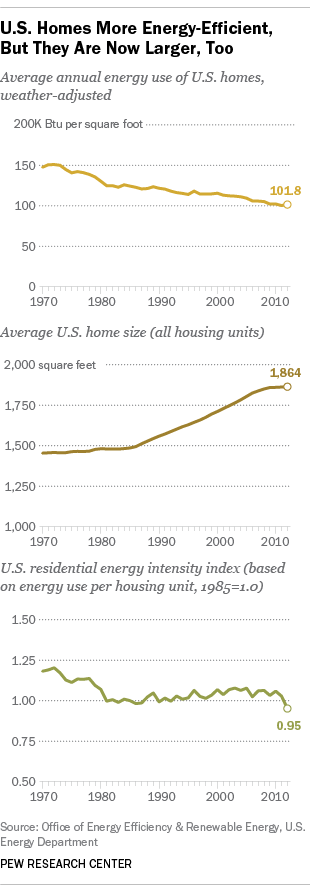

“U.S. homes have become considerably more energy-efficient over the past four decades, according to government data. But homes also are a lot bigger than they used to be, and their growing girth wipes out nearly all the efficiency gains.” – Pew Research Center

Strategies for Living Smaller

Let us assume you agree that the trending home sizes in America are excessive. But how will you live your life in a great-grandparent-sized home of yesteryear? Here are some strategies to live comfortably in a modestly sized home.

- Optimize the Available Space – Look at underutilized spaces for storage such as the attic, basement, or crawl space. On my Resources page, I have provided downloadable plans for attic storage systems that utilize the 24-inch space between trusses for storing plastic totes.

- Avoid Lifestyle Creep – Be mindful of your purchases or the possessions you bring into your life. Something that brings initial pleasure can become burdensome to maintain.

- Keep A Tidy Garage – If you have a 2 car garage make sure you can park 2 cars in the garage. As stated before, entropy happens and stuff will fill the space available. The cars may serve as place-holders to prevent stuff from accumulating. Utilize full-height wall shelves to keep items off the garage floor.

Call to Action

Please don’t stop here. Consider the following actions, and please share your thoughts in the comments below.

- The cost of your home is one of the largest factors that influence your overall financial success. Be mindful of what is driving your decisions and resist lifestyle creep that has the potential to undermine your financial well-being.

- When shopping for a new home consider framing your decision something like this: Would owning 25% more on house result in 25% more happiness?

Links